A Pause for the Fed

By Robert Dietz on January 29, 2025

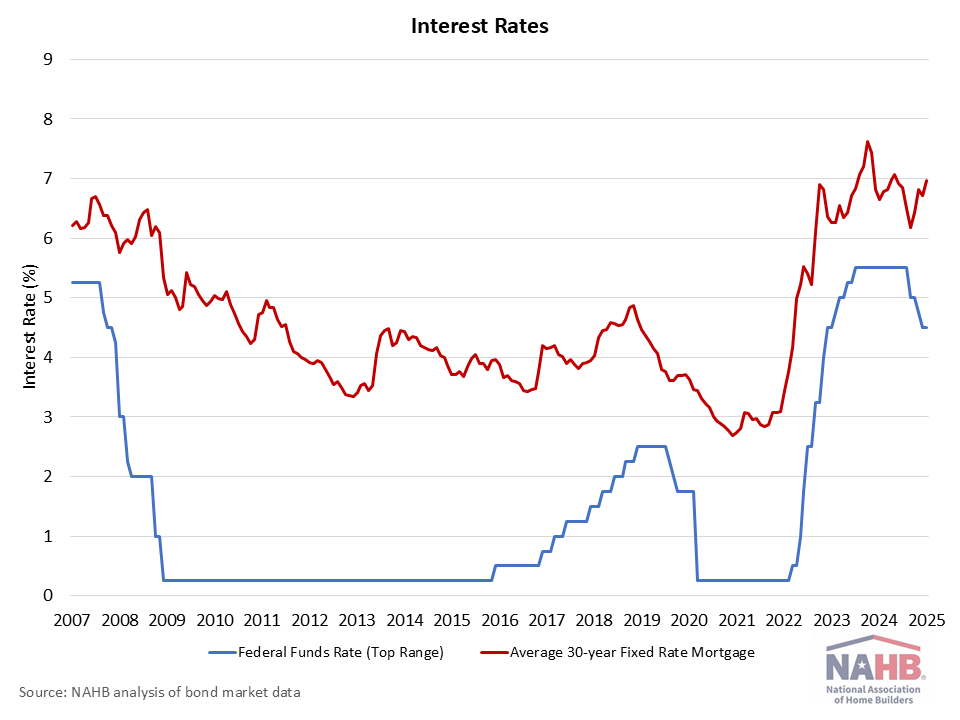

In a widely anticipated announcement, the Federal Reserve paused on rate cuts at the conclusion of its January meeting, holding the federal funds rate in the 4.25% to 4.5% range. The Fed will continue to reduce its balance sheet, including holdings of mortgage-backed securities. The Fed noted the economy remains solid, while specifying a data dependent pause. Chair Powell did qualify current policy as “meaningfully restrictive,” but the central bank appears to be in no hurry to enact additional rate cuts.

In a widely anticipated announcement, the Federal Reserve paused on rate cuts at the conclusion of its January meeting, holding the federal funds rate in the 4.25% to 4.5% range. The Fed will continue to reduce its balance sheet, including holdings of mortgage-backed securities. The Fed noted the economy remains solid, while specifying a data dependent pause. Chair Powell did qualify current policy as “meaningfully restrictive,” but the central bank appears to be in no hurry to enact additional rate cuts.

While the Fed did not cite the election and accompanying policy changes today, the central bank did note that its future assessments of monetary policy “will take into account a wide range of information, including readings on labor market conditions, inflation pressures, and inflation expectations, and financial and international developments.” Given the ongoing, outsized impact that shelter inflation is having on consumers and inflation, an explicit mention to housing market conditions would have been useful in this otherwise exhaustive list.

Chair Powell did state in his press conference that housing market activity appears to have “stabilized.” A reasonable assumption is that this is a reference to an improving trend for rent growth (for renters and owners-equivalent rent), but the meaning of this statement is not entirely clear given recent housing market data and challenges. While improving, shelter inflation is running at an elevated 4.6% annual growth rate, well above the CPI. These housing costs are driven by continuing cost challenges for builders such as financing costs and regulatory burdens, and other factors on the demand-side of the market like rising insurance costs. And more fundamentally, the structural housing deficit persists. Read the rest of the article